- The Daily Spotlight: Stock Watch List

- Posts

- The Daily Spotlight Stock Watchlist for November 6, 2023

The Daily Spotlight Stock Watchlist for November 6, 2023

Don't Miss Your Chance for a FREE 1 Hour Live Training Session

Welcome to another edition of The Daily Spotlight! Today is Nic’s birthday! If he’s helped you make some winning trades then today is a great day to show him some love by buying him some Starbucks (ok, he normally goes to Wawa) or a 5-hour energy because he’s going to need it to stay up long enough to put together a new list later tonight.

Get ready to take your stock trading skills to the next level! We're thrilled to offer you an exclusive opportunity: a FREE 1-hour live training session on mastering the art of stock trading. But here's the catch: you won't have to pay a dime to join us if you refer 10 new subscribers to our newsletter. Think of it as your chance to pay it forward and share the wealth of knowledge. So, spread the word, invite your friends, and let's embark on a journey to financial success together. Get those referrals and secure your spot at this invaluable training session – because learning how to trade stocks has never been this accessible!In today's market analysis, we've identified these stocks based on our criteria. Please conduct your due diligence before making any trading decisions. Remember, the stock market is dynamic, and it's essential to stay updated on news and market trends throughout the trading day.

---

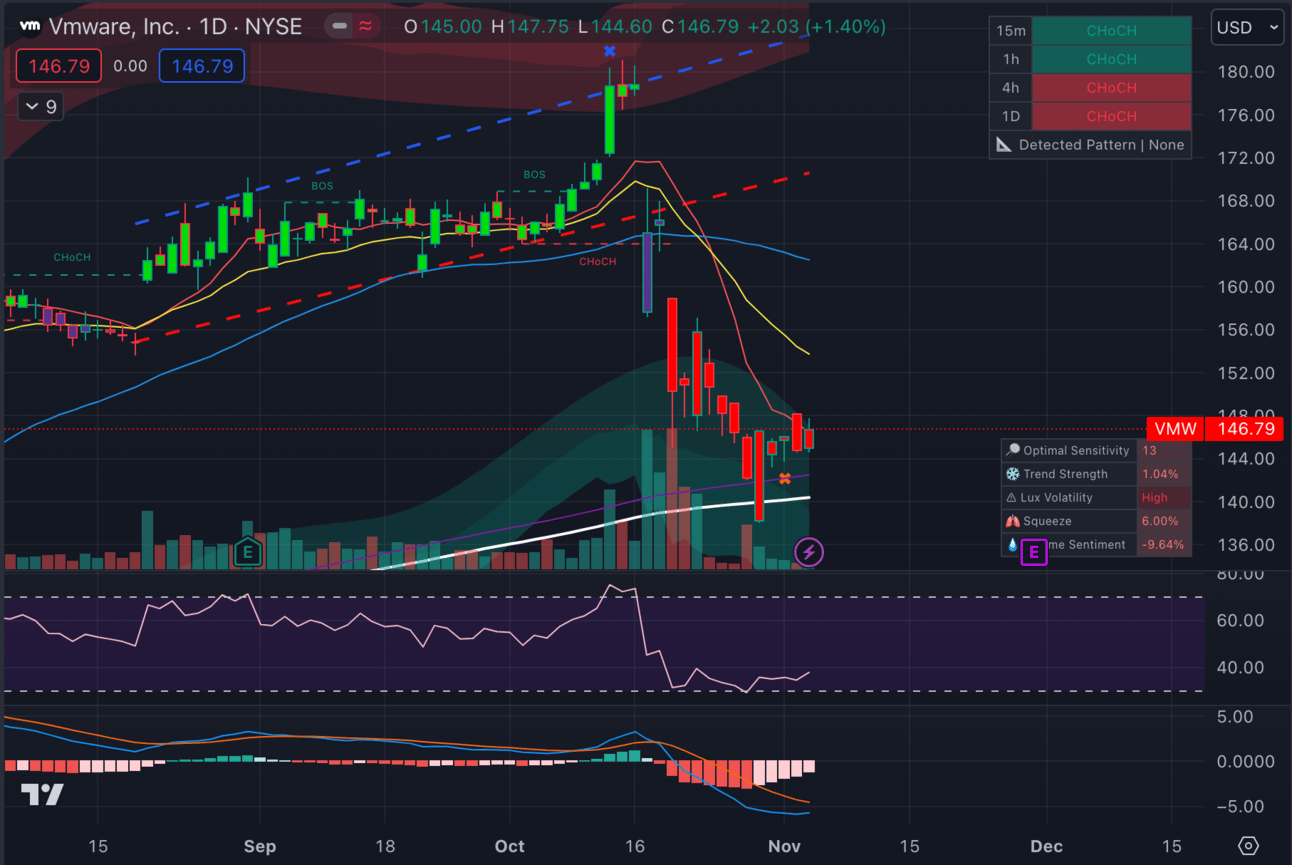

Stock Pick 1: VMW

VMW - Vmware, Inc.

After a several weeks long slide, VMW has found support at the 200 day moving average and entered the Lux Algo buy zone. The RSI has bottomed out and is showing signs of reversal as is a looming bullish crossover on the MACD. VMW has a solid probability of making a move upwards.

Before we dive into the rest of today's stock picks, I'd like to share the trading platform that I personally use and highly recommend – Webull. Their mobile app is a game-changer, offering an intuitive user interface that simplifies trading. With easy access to news, analysis tools, and a vibrant trading community, it's the ideal platform for both beginners and seasoned traders. If you're looking for a reliable broker to enhance your trading experience, check out Webull through my affiliate link below.

https://a.webull.com/gzx5epl18CXTEUKUEW

Stock Pick 2: CRDO

CRDO - Credo Technology Group Holding Ltd.

CRDO checks the boxes. Found support at the 200 day moving average? Check. Full candle close above the 9 day moving average? Check. RSI and MACD indicating the reversal is in? Check. We believe this should move upwards.

Stock Pick 3: WH

WH - Wyndham Hotels & Resorts, Inc.

The would have made Friday morning’s list if it were a little longer, but there’s no reason that WH couldn’t trend up for another day or two. The RSI is a little hotter that we’d normally like to see at entry, but that wouldn’t stop us here. The setup is in place. We’ve got 2 full candle closes above the 9 day moving average, and bullish momentum showing on the MACD.

Stock Pick 4: PEBK

PEBK - People’s Bancorp of North Carolina, Inc.

There’s no compelling reason for PEBK to continue moving upwards here. It was unable to break the resistance at the 200 day moving average during Friday’s trading session and with the RSI at 75 that’s about as much momentum as it should see. It’s now sitting solidly inside the Lux Algo sell zone, so we’d look for this to fall back a little bit off this recent high.

Stock Pick 5: UUP

UUP - Invesco DB USD Index

This is what’s known as “bearish divergence.” If you look at the RSI and MACD, both have been trending down for sometime while the price of UUP has remained relatively steady. Eventually that will break and Friday may have been the day. We could see a steady move downwards from here. UUP, for those of you who may be curious, is how we trade the US dollar.

---

Protect Your Investments with Stop Losses:

One of the fundamental principles of successful trading is risk management, and a crucial tool in your toolkit is the use of stop losses. In the volatile world of the stock market, where prices can fluctuate rapidly, stop losses act as a safety net for your investments. By setting stop losses, you are taking control of your risk, ensuring that even in the event of unexpected downturns, you protect your capital. It's a proactive approach that can help you navigate the ups and downs of the market with confidence, providing peace of mind and enabling you to make more informed, rational decisions. Remember, the key to successful trading is not just about maximizing gains but also safeguarding against losses, and stop losses are a powerful strategy for achieving that balance.

We encourage you to share your thoughts, experiences, and feedback with us. Your insights and questions are always valued.

If you have any questions or need further information about these picks, please don't hesitate to reach out.

Happy trading, and we look forward to sharing more profitable opportunities with you in the days ahead!

Best regards,

Nic

For comprehensive charting and analysis, we highly recommend using TradingView. Click here to get started with TradingView and enjoy a special $15 discount on any new subscription when you sign up through our link. It's an exclusive opportunity to supercharge your trading experience!

Incorporate Lux Algo into your trading toolkit to gain valuable insights and signals that can help you identify stock chart patterns and buy/sell zones with precision. Click here to get started with Lux Algo.

DISCLAIMER: Important Information Regarding Our Newsletter:

Not Financial Advice: The content provided in this newsletter is for informational purposes only and should not be considered as financial advice. The stocks mentioned here are based on our opinions and research. It is essential to conduct your research and consult with a qualified financial professional before making any investment decisions.

Risks Involved: Investing in stocks involves substantial risk, and the value of your investments may fluctuate. You could potentially lose a significant portion or all of your invested capital. Please be aware of the risks associated with trading and investing in the stock market.

Not a Registered Investment Advisor: We are not registered investment advisors and are not authorized to provide financial advice. The information shared in this newsletter is intended for educational purposes and should not be interpreted as personalized investment guidance.

Potential Conflicts of Interest: We may or may not own positions in the stocks discussed in this newsletter. Our interests in these stocks could create a conflict of interest that may affect the objectivity of our analysis. We are not obligated to disclose our positions in the mentioned stocks.

No Guarantees: There are no guarantees of profit or success in the stock market. Past performance is not indicative of future results. The information in this newsletter should not be regarded as a promise or guarantee of future gains.

Readers' Responsibility: Readers of this newsletter are responsible for their investment decisions and should perform their due diligence, consider their risk tolerance, and seek professional advice when needed.

Liability Waiver: We are not liable for any financial losses or damages that may result from actions taken based on the content of this newsletter. By reading and acting upon the information provided, you acknowledge and accept the associated risks and release us from any liability.

Accuracy and Updates: We make reasonable efforts to ensure the accuracy of the information provided, but we do not warrant its completeness or reliability. The stock market is dynamic, and the information may become outdated. It is your responsibility to verify the accuracy of any data before making investment decisions.

By subscribing to and reading our newsletter, you agree to the terms and conditions outlined in this disclaimer. If you do not agree with these terms, you should refrain from using the information provided in this newsletter.